Little Rock Ar Tax . the little rock sales tax is collected by the merchant on all qualifying sales made within little rock. the 8.625% sales tax rate in little rock consists of 6.5% arkansas state sales tax, 1% pulaski county sales tax and 1.125%. the city of little rock does not levy an income tax. Little rock collects a 2.5%. now you can use paypal, paypal credit, venmo, google & apple pay and western union quick collect to pay your property. look up any little rock tax rate and calculate tax based on address. The sales and use tax rate for the state of arkansas is. Look up 2024 sales tax rates for little rock,. we collect personal property taxes, as well as municipal, county, school, and special improvement district taxes.

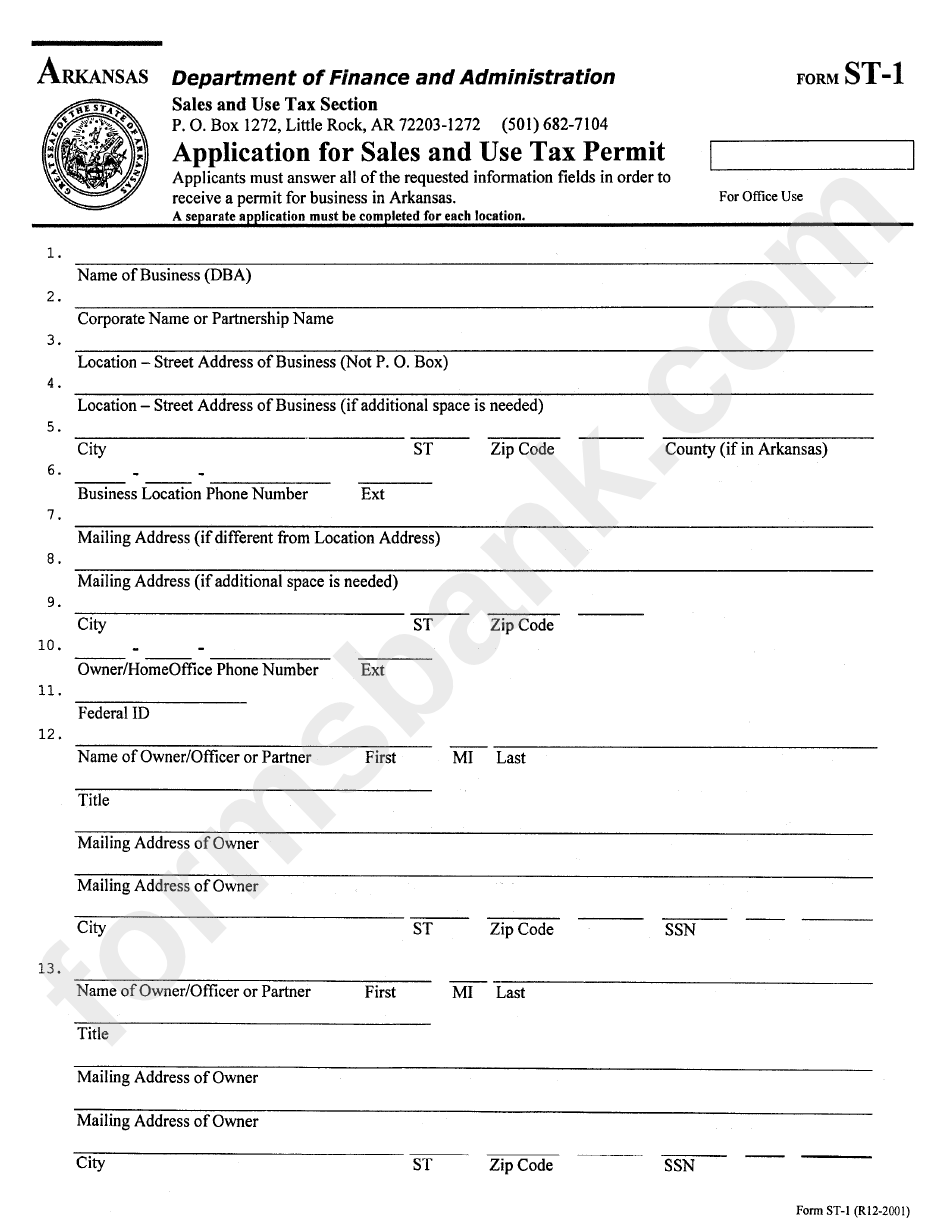

from www.formsbank.com

Look up 2024 sales tax rates for little rock,. look up any little rock tax rate and calculate tax based on address. Little rock collects a 2.5%. now you can use paypal, paypal credit, venmo, google & apple pay and western union quick collect to pay your property. the 8.625% sales tax rate in little rock consists of 6.5% arkansas state sales tax, 1% pulaski county sales tax and 1.125%. The sales and use tax rate for the state of arkansas is. we collect personal property taxes, as well as municipal, county, school, and special improvement district taxes. the city of little rock does not levy an income tax. the little rock sales tax is collected by the merchant on all qualifying sales made within little rock.

Form St1 Application For Sales And Use Tax Permit Little Rock

Little Rock Ar Tax Little rock collects a 2.5%. the little rock sales tax is collected by the merchant on all qualifying sales made within little rock. the city of little rock does not levy an income tax. look up any little rock tax rate and calculate tax based on address. Look up 2024 sales tax rates for little rock,. the 8.625% sales tax rate in little rock consists of 6.5% arkansas state sales tax, 1% pulaski county sales tax and 1.125%. we collect personal property taxes, as well as municipal, county, school, and special improvement district taxes. The sales and use tax rate for the state of arkansas is. now you can use paypal, paypal credit, venmo, google & apple pay and western union quick collect to pay your property. Little rock collects a 2.5%.

From www.nwaonline.com

Taxation of Arkansans’ student loan debts to be decided next Little Rock Ar Tax look up any little rock tax rate and calculate tax based on address. Little rock collects a 2.5%. now you can use paypal, paypal credit, venmo, google & apple pay and western union quick collect to pay your property. the little rock sales tax is collected by the merchant on all qualifying sales made within little rock.. Little Rock Ar Tax.

From www.facebook.com

EXP Arkansas Little Rock AR Little Rock Ar Tax Little rock collects a 2.5%. now you can use paypal, paypal credit, venmo, google & apple pay and western union quick collect to pay your property. The sales and use tax rate for the state of arkansas is. the 8.625% sales tax rate in little rock consists of 6.5% arkansas state sales tax, 1% pulaski county sales tax. Little Rock Ar Tax.

From www.arkansasonline.com

As tax rates go, Arkansas at top Little Rock Ar Tax now you can use paypal, paypal credit, venmo, google & apple pay and western union quick collect to pay your property. Look up 2024 sales tax rates for little rock,. the 8.625% sales tax rate in little rock consists of 6.5% arkansas state sales tax, 1% pulaski county sales tax and 1.125%. we collect personal property taxes,. Little Rock Ar Tax.

From www.facebook.com

Little Rock Federal Credit Union Little Rock AR Little Rock Ar Tax the city of little rock does not levy an income tax. the little rock sales tax is collected by the merchant on all qualifying sales made within little rock. Little rock collects a 2.5%. look up any little rock tax rate and calculate tax based on address. the 8.625% sales tax rate in little rock consists. Little Rock Ar Tax.

From www.facebook.com

ERGA Tax Little Rock AR Little Rock Ar Tax Look up 2024 sales tax rates for little rock,. now you can use paypal, paypal credit, venmo, google & apple pay and western union quick collect to pay your property. the little rock sales tax is collected by the merchant on all qualifying sales made within little rock. The sales and use tax rate for the state of. Little Rock Ar Tax.

From www.facebook.com

Latinos Tax Service Little Rock AR Little Rock Ar Tax look up any little rock tax rate and calculate tax based on address. the city of little rock does not levy an income tax. now you can use paypal, paypal credit, venmo, google & apple pay and western union quick collect to pay your property. Look up 2024 sales tax rates for little rock,. we collect. Little Rock Ar Tax.

From www.arkansasonline.com

Panel pares list of Arkansas taxes due review The Arkansas Democrat Little Rock Ar Tax The sales and use tax rate for the state of arkansas is. Little rock collects a 2.5%. the 8.625% sales tax rate in little rock consists of 6.5% arkansas state sales tax, 1% pulaski county sales tax and 1.125%. the city of little rock does not levy an income tax. Look up 2024 sales tax rates for little. Little Rock Ar Tax.

From www.creditkarma.com

Filing an Arkansas State Tax Return Things to Know Credit Karma Little Rock Ar Tax now you can use paypal, paypal credit, venmo, google & apple pay and western union quick collect to pay your property. the city of little rock does not levy an income tax. the little rock sales tax is collected by the merchant on all qualifying sales made within little rock. we collect personal property taxes, as. Little Rock Ar Tax.

From www.facebook.com

Tax Coach RO Little Rock AR Little Rock Ar Tax Look up 2024 sales tax rates for little rock,. we collect personal property taxes, as well as municipal, county, school, and special improvement district taxes. Little rock collects a 2.5%. look up any little rock tax rate and calculate tax based on address. now you can use paypal, paypal credit, venmo, google & apple pay and western. Little Rock Ar Tax.

From www.loopnet.com

1924 Commerce St, Little Rock, AR 72206 Little Rock Ar Tax The sales and use tax rate for the state of arkansas is. Little rock collects a 2.5%. the little rock sales tax is collected by the merchant on all qualifying sales made within little rock. the city of little rock does not levy an income tax. now you can use paypal, paypal credit, venmo, google & apple. Little Rock Ar Tax.

From www.financestrategists.com

Find the Best Tax Preparation Services in Little Rock, AR Little Rock Ar Tax Little rock collects a 2.5%. the little rock sales tax is collected by the merchant on all qualifying sales made within little rock. we collect personal property taxes, as well as municipal, county, school, and special improvement district taxes. look up any little rock tax rate and calculate tax based on address. the 8.625% sales tax. Little Rock Ar Tax.

From www.trulia.com

110 W 52nd St, N Little Rock, AR 72118 MLS 23037252 Trulia Little Rock Ar Tax the city of little rock does not levy an income tax. Little rock collects a 2.5%. The sales and use tax rate for the state of arkansas is. Look up 2024 sales tax rates for little rock,. the 8.625% sales tax rate in little rock consists of 6.5% arkansas state sales tax, 1% pulaski county sales tax and. Little Rock Ar Tax.

From www.facebook.com

Extreme Tax Planning Little Rock AR Little Rock Ar Tax look up any little rock tax rate and calculate tax based on address. Little rock collects a 2.5%. the little rock sales tax is collected by the merchant on all qualifying sales made within little rock. we collect personal property taxes, as well as municipal, county, school, and special improvement district taxes. the 8.625% sales tax. Little Rock Ar Tax.

From www.facebook.com

Performance Tax Group Little Rock AR Little Rock Ar Tax the little rock sales tax is collected by the merchant on all qualifying sales made within little rock. the city of little rock does not levy an income tax. The sales and use tax rate for the state of arkansas is. Little rock collects a 2.5%. Look up 2024 sales tax rates for little rock,. we collect. Little Rock Ar Tax.

From www.facebook.com

Little Rock Tax Queen East End AR Little Rock Ar Tax The sales and use tax rate for the state of arkansas is. look up any little rock tax rate and calculate tax based on address. Look up 2024 sales tax rates for little rock,. the city of little rock does not levy an income tax. the 8.625% sales tax rate in little rock consists of 6.5% arkansas. Little Rock Ar Tax.

From www.tripadvisor.com

LITTLE ROCK MARRIOTT 159 (̶1̶9̶9̶) Updated 2022 Prices & Hotel Little Rock Ar Tax Little rock collects a 2.5%. Look up 2024 sales tax rates for little rock,. look up any little rock tax rate and calculate tax based on address. the city of little rock does not levy an income tax. the little rock sales tax is collected by the merchant on all qualifying sales made within little rock. Web. Little Rock Ar Tax.

From arkansasadvocate.com

Little Rock housing authority failed to follow spending and contracting Little Rock Ar Tax The sales and use tax rate for the state of arkansas is. now you can use paypal, paypal credit, venmo, google & apple pay and western union quick collect to pay your property. the city of little rock does not levy an income tax. Look up 2024 sales tax rates for little rock,. the little rock sales. Little Rock Ar Tax.

From www.ebay.com

Retail Liquor Dealer Special Tax Stamp FYE 1968 Taxpaid Little Little Rock Ar Tax the 8.625% sales tax rate in little rock consists of 6.5% arkansas state sales tax, 1% pulaski county sales tax and 1.125%. Look up 2024 sales tax rates for little rock,. the little rock sales tax is collected by the merchant on all qualifying sales made within little rock. The sales and use tax rate for the state. Little Rock Ar Tax.